Sohrab:

Let me quickly introduce our first speaker today, Bjarte Bogsnes. I hope I got his name right. And Bjarte has been one of the initiators, let's call it this way, of the Beyond Budgeting initiative or movement. He has worked almost four decades in the industry starting out, I think, with Borealis, and then later they became part of Equinor, you can correct me on that, Bjarte. And he has built a lot of experience, not in theory, but in real practice, on how you can build budgets or something equivalent to them in a different way. And that different way is, in many cases, much more coherent, much more compatible to agile ways of working in organizations, but the link between Beyond Budgeting and agile, either Bjarte will cover this in his presentation, or I'm sure we will then later talk about this once we get started in our Q&A. So, Bjarte, I'm handing over to you, it's your stage, very much looking forward to hearing from you and very thankful that you're donating your time to us.

Bjarte:

Thank you. And let me share my screen here. I hope you can see this one.

Sohrab:

Yep, it works.

Bjarte:

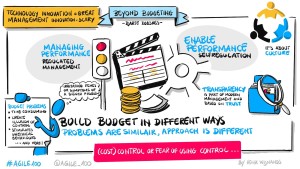

So Beyond Budgeting, it's business agility in practice, Beyond Budgeting is actually about much more than budgets, as you will find out in case you didn't know. And just as you know, my first management job back in Statoil, as we were called, then in the early '80s, that was Head of the Corporate Budget Department. So I've been heading up more budget processes in my life than I want to be reminded about, but I know what I'm talking about. And also, even if I'm the finance guy, I've also worked in Human Resources heading up the HR function in this company, Borealis, where we had the chance to kick off the budget already in 1995. And that was a big wake-up call for me when it comes to the people side of Beyond Budgeting. Every time I discuss Beyond Budgeting with people, there is one word that keeps coming up. And that is the word control.

And the context is, of course, the fear of losing control. And when I asked people, "What do you mean with control?" after the people have said cost control, many go quiet. They actually struggle with defining, putting words on what they are so afraid of losing, which is quite interesting. If we go to Oxford Dictionary, they call it the power to influence or direct people's behavior, or the costs of events. And what does this mean in organizational terms, business terms? Well, that basically means controlling people and controlling the future.

And behind these two lies the two main assumptions that underpins almost everything in traditional management. Number one, you can't trust people. Number two, the future is predictable and plannable. And we are challenging both those assumptions in Beyond Budgeting, because these are nothing but illusions of control, for instance, that people can and must be managed. Well, of course, you can manage people. But if people are managed in stupid ways, they hopefully find a way around in order to get their work done.

And when it comes to the future, the only thing that we know is that we don't know. Wise people have agreed with what I've just said, when it comes to people good old Peter Drucker, "Most of what we call management is about making it difficult for people to do their job." And when it comes to corporate planning, another guy, Russel Ackoff, he compared it after the planning he was observing in large companies with a ritual rain dance. It has no effect on the weather, but those who engage in it, think it does. And I understand what he means and I have done a lot of dancing in my life through these budget processes. I'm not really sure it actually helped on the performance of the company. Okay, so much for wise people.

Why is Beyond Budgeting Important in a performance oriented world?

Imagine an organization that 100 years ago invented a fantastic machine, state of the art and key for the success of this organization. Fifty years ago, this machine started to make some trouble. And today this machine is completely broken, kaput. You will probably understand that this is not the true story. Because in real life, people would have gotten together 50 years ago and done something here, either try to fix the machine, or even better, try to invent a new machine because innovation is something we all love. Innovation is great. We all want to be leading edge, unique, right there in the forefront, better than everybody else. But that enthusiasm for innovation seems to be limited to technology, innovation into products and services. But there is also something called management innovation that we are talking about today. And management innovation, that doesn't seem to be equally great, that is scary, kicking out the budget, are you crazy? The consequence is that it's very crowded on the left-hand side, everybody is into that kind of innovation in some form or shape.

The management innovation arena is not yet a crowded place, because it is scary. But that is actually good news for brave companies who dare to explore and embrace also this kind of innovation, because you can get just as much performance competitive advantage out of management innovation as you can from technology, innovation. And there are companies out there who openly admit that we have no advantage whatsoever in what we produce and what we sell. We find it in the way we lead and manage. And I've got a few examples for you in a minute.

This performance world is important that is the reason we should go beyond budgeting because it is good for performance defined in the right way. And I want to reflect a little bit on that world in a slightly different setting than business and organizations. Because some of you know that I like to use traffic as a metaphor. Because in traffic when we are out driving, we would also like to experience good performance, a safe and good flow.

And before that one slide, by the way, this is called Beyond Budgeting. It has of course something to do with budgets. And before I take that metaphor, I want to share with you my budget problem list, I'm doing that to show that the problems here are actually more serious than what you often think. It's a very time-consuming process, making budgets, following up budgets, assumptions quickly outdated. This is a serious problem. It stimulates unethical behaviors, the lowballing, the gaming, the sandbagging, the resource hoarding, the internal negotiations, all the things that we don't want to experience in our organizations. It creates illusions of control, as we just talked about. And if you don't have control, whatever that means, it is better to acknowledge that and act accordingly, not to think that you have control and act accordingly.

Budgeting forces us to make decisions too early, we have to decide in often the year before what we shall do, and what it shall cost. And in many organizations, too many of these decisions are taken too high up, it doesn't always improve the quality of those decisions. Very often it's the other way around. Budgets can prevent us from doing things that we should have done, but we can't because it's not in the budget. But this also works the other way around, it can actually lead us to do things that we maybe shouldn't have done, but it is in the budget and if you spend it or lose it.

And link to this, I acknowledge that the budget, the cost budget can be a very effective ceiling for cost. But it is just as effective as a floor in the sense that these budgets tend to be spent for the reasons we just discussed. And to define good performance as hitting the budget numbers is a very narrow mechanical and sometimes a completely outdated language for describing good performance. We need a richer, broader performance language. I have been sharing this list of problems with hundreds of thousands of people around the world in the 25 years I've been working with Beyond Budgeting. And most people actually agree, executives, managers, even finance people.

At the same time, most organizations continue doing this stuff, which is quite interesting. And I'll come back to why in a minute. I just want to add on one more problem that actually not that many people have on their list I've called it conflicting purposes. And the interesting thing with this problem is that it is both the problem and the solution. And behind this lies the fact that companies use budgets for three different things, to set targets financial target sales targets. And so one at the same time, this budget shall be a forecast of what next year can look like. And it is also a resource allocation process, handing back knowledge to the organization.

And it might seem very efficient to solve all three in one process and one set of numbers. But that's also the problem. Because what happens if we move into a budget process, we won't understand next year's cash flow. And we ask people responsible for revenues, "What's your best number for next year?" but everybody knows that the number I'm sending upstairs will come back to me as a target for next year, maybe with a bonus attached. And if he asks the same in other people for their best costs, or investment numbers, everybody knows that this is my only shot that getting access to resources for next year.

And some might also remember that 20% cut of last year, and that memory and that insight might also do something to the level of numbers submitted. And this is a problem, not just because it destroys the quality of numbers, but also because it stimulates this, at least borderline unethical behavior, even if I don't want to blame people, because people respond to the system that we have set up for them. So this is not about fixing people, it's about fixing the system and that will change the behavior. And the solution here is we can still do all these three things. But we shall do these three things in three separate processes. Because these are different things. A target is an aspiration, a forecast is an expectation. And resource allocation is about optimizing scarce resources. And once we have separated we can start to improve each one.

That was the closest to budgets and finance we get in this session.

I think one reason why so many continue doing this stuff is that these problems are regarded more as irritating itches and are symptoms of a bigger and more systemic problem. But that is exactly what they are, symptoms of a huge problem, which is also a paradox. Because here we have a process invented roughly 100 years ago, it's pretty old management technology we are talking about. And in case you don't know, the inventor was Mr. James O. McKinsey. And I never met Mr. McKinsey, but I don't think he was an evil man. I think he had the best of intentions. He wanted to help organizations perform better. And I'm sure this worked 100 years ago, maybe even 50 years ago, but no longer today, because today, as we will come back to, things have changed.

But to get back to this important word, performance, and as I said, I like to use traffic as a metaphor. And these are the two normal ways of managing traffic when there is crossing traffic. And if you think about a traffic light, the one who makes decisions here is the one who programmed this light. And that person would not be in the situation when you sit there waiting for that green light. And the information that this programming would be based on would not be entirely fresh information.

It is a model where you are not trusted. And it's a model where transparency is not important. As long as you can see the color of the light, that's it, that is enough. And it is also a model where values is not important. If there is a mindset of me first, I don't care about the rest, that is not the big problem in front of that light. Whereas in the roundabouts, me first, I don't care about the rest is a big problem, because here we are much more dependent on everybody sharing a positive purpose or wish or wanting this default, well, we have to interact with each other, we have to help each other in a very different way than what you need to do in front of that light. And of course, here we make decisions and the information we use is fresh real-time information.

Managing Performance

So the roundabout is about managing performance. No, sorry the traffic light is about managing performance. The roundabout is about something else. This is about creating conditions for great performance to take place. It's about enabling performance instead of managing performance. And this is more than playing with words. These are two fundamentally different ways to be addressing that big question how do you get the best possible performance in organizations?

The roundabout is a more self-regulating way of managing and self-regulation is another important word here. And organizations today need more self-regulating management models for at least two reasons.

One reason is our business environment with all the VUCA after the volatility, the uncertainty, the complexity, ambiguity, and with that high level of guide that must have implications for how we design or manage the models compared to if there was little or no VUCA out there.

The other reality we need to reflect on is internal, has to do with people, asking ourselves what kind of people do we generally believe that we have in the organization. And we use Douglas McGregor's Theory X and Theory Y as a label for that discussion. So do you believe that people... Theory X, that people are a bunch of potential thieves and crooks that almost be kind of kept in short leases or micromanaged. If not, they will all run away and do a lot of stupid things. Or do you believe that people actually want to do a good job, want to be involved, want to be listened to, want to be treated as adults? And again, your belief here must have and will have consequences for how you design your management model.

And if we combine the two, it could look like this: you recognize the two dimensions and traditional management lies in this lower left-hand corner. And if we want to get out of that, we need to address both dimensions, both leadership horizontally, and our management processes vertically. And what we need to get out of traditional management very rigid, detailed annual rules-based micromanagement centralized command or control, a lot of secrecy, and a strong belief in sticks and carrots as ways to drive performance.

What we need to do here to get out of it is on the leadership side, more purpose-based more values-based, more autonomy, more transparency, not just as a learning mechanism, but also as a control mechanism. There are companies, and I'll come back to an example that have transparency as their only control mechanism.

And last but not least, internal or intrinsic motivation as opposed to external or extrinsic motivation. And, of course, the most common mechanism in business today for motivating people externally is individual bonuses. And I can think of no area where there's a bigger gap between what research is telling us and what business is practicing. It is simply amazing. Many organizations, they have the best of intentions on the people side in what they say and what they write. But it doesn't help to have this theory why leadership visions if we have Theory X management processes, and that is the case in a lot of organizations. And that creates poisonous gaps between what they preach and what they practice.

So what you need to do in the management process dimension is to change these processes to better reflect our people view, which is hopefully, Theory Y, while at the same time making our management processes more view boost. And this is where you're coming to the budget, because the budget, you typically need to do something really traditional detailed on your budget because it represents so much of what you find in that lower left-hand corner. More specifically, when we shall set targets and goals to the extent we shall do that. We recommend some inspiration from football, I have yet to meet a football team saying that the ambition for next season is to score certain on goals and get 42 points. Those are budget goals. And they don't think like that. It's all about league tables, and doing well against piercing competition.

And in many instances, that kind of thinking can make sense in business as well. We also need more dynamics into these processes. Why shall everything circulate around the fiscal year or typically January to December. So where is possible, we need more business we have in more event proven results. And last but not least, we cannot reduce performance evaluation to comparing two numbers and then conclude again, we need a richer, broader performance language.

And this, my friends, was a crash course and Beyond Budgeting. This is what it is about addressing both leadership and management processes in a coherent, consistent way, in order to become more adaptive and more human. And Beyond Budgeting, again, as you can see, it is about business agility.

A number of companies are on this journey today in some form or shape. And I could have talked for hours here fascinating stories about brave companies exploring management innovation, we don't have the time. So two quick examples. Let's start in Norway. In the upper right-hand corner, you'll see a company called Miles it's an IT company business in Norway, the Baltics, South Africa, and India. Miles have no budgets, no targets. If you work for Miles, you can buy whatever PC you want, replace it as often as you want, as expensive as you want. No PC budgets. You can attend whatever conference and seminar you want, as often as you want, wherever in the world, no training budgets, no travel budgets. But it's not an anarchy, they have a very simple control mechanism. When you have bought that PC, when you have returned from the training, you need to post on the internet what you did and the cost of it. So transparency is their only control mechanism. And they have no problems whatsoever with cost.

The Handelsbanken

The second company I want to talk about here is very much the pioneer within Beyond Budgeting. It's a bank, you see them in the middle here at the top, a Swedish bank called Handelsbanken that has around 700 branches in Northern Europe quite big in the UK. Handelsbanken has no budgets, no targets, no individual bonus. And they have been operating like this since 1970. So we have a nice long period to look back at to see does this stuff work. Is it good for performance?

And the performance tracker is simply amazing. This bank has been performing better than the average of its competitors every single year since 1972. This is among the most cost-effective universal banks in Europe. And the bank has never needed any bailout from the authorities because they messed it up. Very different management model from most other banks, a lot of autonomy, a lot of transparency, they use a lot of league tables to compare branches, mainly to stimulate learning, but also as a kind of gentle performance push because nobody likes to be laggards.

Handelsbanken and some other companies, including Borealis that we talked about, inspired what became known as Beyond Budgeting in the late '90s. So these principles were actually formulated three years before the Agile Manifesto. At the time, there was no contact whatsoever between those two communities. That has fortunately changed, which this session is an example of. But you can see that there are many similarities between the two. I think the big difference is that the Agile Manifesto was not developed as a way to run a big organization. It was initially developed to improve software development, Beyond Budgeting was born in order to help organizations or improve the way organizations are run. So there are things that Beyond Budgeting addresses that Agile actually misses, but they complement each other very well.

A few reflections on this slide before I'm going to finish my presentation here. As you can see, we are addressing both leadership and management processes for the reasons that I just talked about. I don't think what we say on the leadership side necessarily is that unique because many other communities have a similar view. But very often these movements haven't reflected very much about what kind of management processes you will need to activate these leadership principles.

And likewise, there are some other good management models out there, but they haven't reflected very much on what kind of leadership must underpin this. We are looking at both, and coherence between the two is key here. A classical example of the opposite, it doesn't help that we talk loud and warm on the left-hand side about how fantastic people we have on board and we would be nothing without you and we trust you so much. But not that much. Of course, we need detailed travel budgets, are you crazy? Hypocrisy is what I call it, right, poisonous gaps. There has to be a coherence.

Also, these are principles. This is not a management recipe. What this should mean in an organization depends on that organization's business culture, values history as the way it should be. I don't like management recipes because, in the management recipe, somebody has done all the thinking for you. The only thing you have to do is to read the books, hire the consultants, tick the boxes. I find that both boring and dangerous. Here, you have to think for yourself.

Last point here, two classical misunderstandings around Beyond Budgeting both linked to principle 10. Some people think it's just another way of managing costs. Well, it is but there are 11 other principles. This is quite a comprehensive management and leadership model. Second misunderstanding, no budgets, I can spend whatever I want cost is not important. Sorry, that's not what we are saying. Cost is still important together with other things in order to create value and often it will be constrained. What we are offering are more intelligent, effective ways of optimizing within that constraint compared to what Mr. McKinsey could offer us 100 years ago.

So that is what I wanted to share with you. If you want to explore further here, these are my contact details I took early retirement from Equinor, just actually a few weeks ago, and have set up Bogsnes Advisory. So check out the website if you're interested. And also check out the Beyond Budgeting Round Table. And I'm also quite active on Twitter and LinkedIn. And I only tweet about this stuff. There's no cats and dogs and grandchildren, I promise. What you've heard here was the very, very short version. If you want to hear a longer version, it looks like this.

This book has more about the problems with traditional management more about the model and cases here, including the Borealis and Statoil case, there's a chapter about Beyond Budgeting in Agile, because of all the similarities, and obviously, more about implementation, which I have not been able to cover here. Maybe we can come back to that in the Q&A. So on that note, I'm gonna stop my sharing, and I look forward to questions and discussions. Thank you.

Conversation between Bjarte Bogsness and Sohrab Salimi about Beyond Budgeting

Sohrab:

Bjarte, thank you. Thank you for giving us this wonderful crash course. It was really, really fast. I was like, what, there was a crash course in Beyond Budgeting? But very insightful. Thank you. Also, as mentioned earlier, some of you joined while Bjarte was giving his presentation, the presentation will be shared. So you will also get his contact details and can connect with him afterwards.

But now let's use the remainder of our time, we have around 22 minutes for Q&A. And I'll kick this off, I wrote down a few questions. And for all of you listening to this, feel free to put your questions into the chat. And I will make sure that within the time that we have I address as many of those as possible.

But let's start with something that came to my mind. You talked about many different types of innovation and management innovation being for many organizations the one key differentiator. Gary Hamel is another famous person that talks about this a lot. He actually has his ladder of innovation basically, or innovation stack and management innovation being the one with the highest impact. And you already gave a few examples around management innovation connected to the topic of budgeting, for example, taking away like traveling budgets, but replacing them with policies with regards to transparency, etc. So there is some kind of responsibility and control so it's not anarchy. Do you have other examples that you can share with us, I'm sure you do, where you can also like, which are easy to implement, because the one that you already mentioned, is quite easy to implement, it doesn't take a lot to do it, do you have a few more that you can share with us?

Bjarte:

For now we're on the cost side on managing cost then I can give you a few examples from Equinor. One alternative that the company use is burn rate guiding. So there's no budgets, but there might still be a number in the range of a million, 10 million, 100 million as a guiding so that you're not completely in the dark about what kind of activity level you should operate at until something else is decided. Within that burn rate guiding you have full autonomy to make the right decisions. So that's one alternative.

If it's an operating producing unit, you can use, for instance, unit production cost targets, you can spend more if you produce more, you can have benchmark unit production cost targets. And if you have internal units who are true profit centers who kind of fully control their own cost and income side, if they have some kind of bottom line target, they cannot run away and spend money like drunken sailors, but it might be okay to spend more of what we call good costs because good cost is not the problem. As long as we have the financial capacity, we want more good costs because they create value. It's the bad costs we want to get rid of.

Sohrab:

That's the stuff we want to cut out. Okay, cool. So someone is already... okay. Now, the second point you talked about and immediately it enlightened something in me, was the difference between targets being aspirations and forecasts being expectations. And I immediately had to think about all of these organizations that I supported in the past as a management consultant, creating strategies, etc. But even today, when I work with them on changing their organizational setup, management processes, etc., now this is my perspective and I want to be challenged by you on this one, they don't make that distinction between aspiration and expectation. The aspiration becomes the expectation. And first question, do you see that as well? And two, how do you make sure that people actually distinguish between those things? Because I think it's fine to have higher aspirations, also fine to have high expectations. But the expectations need to be realistic, the aspirations can be, at least in the short-term, unrealistic.

Bjarte:

That's a good question. Before I answer that one, I want to add on one thing I forgot on your previous question about managing costs. Because the example I will give us some similarities with continuous delivery in Agile. Equinor has no traditional detail investment budget, where you sit in the autumn and decide everything, we shall invest exactly this much, and exactly on these projects, and then you hand out these bags of money as next year's project, or investment money. Instead, there's a process based on the concept that the bank is always open. So the line can always forward a proposal for a project, yes or no. Depends on two things, how good is your project? And do we have the capacity as things looks today? So this is continuous delivery, not of software functionality, but of decisions and financial resources. So again, dynamic resource allocation, we call it.

But back your questions, I mean, these are different things. And when it comes to that expectation, that should be brutally honest, the expected outcome, whether we like what we see or not. And we're using that information to help us to get to where you want to go, namely, the target, to the extent we shall have targets. If there's time, we can take that discretion also afterwards. But if you have targets and you need a forecast you can trust to see kind of where you are heading.

And the way to make this happen is, again, to set up formal processes, a process where we establish targets, preferably that people set their own targets. And the forecasting process, where you get people to understand that this is just a forecast. Those numbers, it's not a bid into a target negotiation. It's not an application for resources because we've got different processes for that.

And the beauty with starting Beyond Budgeting here is that this is pure logic, that the three purposes and the separation is something CFOs understand. And it's not scary. But once you're separated, and you move into improvement goal, how can we set better targets? How can we improve the forecasting process, improve resource allocation? You are moving into these bigger discussions around Beyond Budgeting, what real targets I think, what really motivates people, resource allocation, do we need detailed travel budgets if we say we trust people, and so on, and so on. So it's a nice, not scary way of getting started. And I've helped around 30 of the companies on that list to get started. And with the majority of them, this is where we started out, the separation of the purposes.

What motivates people?

Sohrab:

Okay, I will get back to that where we started out because I have a whole round of questions around when to start and what to start with. But before I do that, you talked about the things that motivate people and one of our participants is asking about bonuses, right? In many organizations, that's the number one way that organizations try to motivate people and we know this science doesn't back this up that this would work. So can you please tell us more about how that works in the Beyond Budgeting philosophy, let's put it this way.

Bjarte:

We have principle 12 of the 12 principles is about the bonus and we advocate common bonus schemes driven by so everybody on board and for instance driven by how the company is doing versus other companies. So the economic bonus is organized like that and we stole that idea from Handelsbanken, the Swedish bank. So that is... and then you know, that is not meant to be a kind of do this and get that motivation thing, right? It's more it motivates but it's more a kind of a common clap on the shoulder everybody after the fact. It's not a dangling carrot.

And also, you know, I'm dead against individual bonuses. I've been on that scheme for many years. Of course, I enjoyed the money, but if somebody thinks that is what motivated me they hadn't done their homework. And I would actually call it individual bonus, it's managerial laziness. Because it is much easier than to take the leadership role or working with mastery, purpose, autonomy, and belonging, and all the other things that we know were so much more effective. So, I think that's one reason why it is still so popular.

Sohrab:

Yeah, I can definitely back that up. Individual bonuses being managerial laziness, especially when you tie those individual bonuses to specific numbers that the person needs to hit.

Bjarte: Yes.

Sohrab:

And I see that happening with also boards of directors who have to ultimately decide on the CEO pay and bonus, that they are so afraid of having that difficult conversation, which requires them to really understand what the organization has been working on and what the CEO has been doing with their team. And because of that, they try to... they spent so much time in just finding out some arbitrary numbers based on which they want to like evaluate a person's work. All right. so...

Holistic Performance Evaluation

Bjarte:

I can also add on here that Equinor, it still has some individual bonuses. But what the company has is what we call a holistic performance evaluation. And that means two things. First of all, the most important principle in the company is that how you deliver is as important as what you deliver, and with how you deliver, we talk about the values in the company. And the waiting between the two, you know, consequences for your career and pay is 50/50.

The other part of holistic is that when you shall assess what is delivered in business terms, it's not just a question of looking at measurements or numbers. That can be a starting point, but you need to go behind the numbers, behind the measurement, and look at things that measurement did not pick up. Right, I see that your KPI is green but have you really moved towards those strategic objectives? How ambitious were your targets? Should we punish somebody that stressed themselves and didn't make it and do the opposite for somebody who lowballed the game and made it? Has to been significant changes in assumptions headwind, tailwind that we should take into account. So this qualified discussion, the assessment, in addition to measurements is also something we recommend in Beyond Budgeting. Again, we call it the holistic performance evaluation.

Sohrab:

And I think that's one of the important areas where managers are still needed in an organization, but they need to focus their time on completely different things than they're probably focusing their time on right now. Right, so I'm going to steal this quote, individual bonuses are based on managerial laziness. So thank you for that. Now, there are a few questions in the chat around the topic of change in an organization. Right. And you have seen this, I've seen this, I think many of the participants have seen this.

Many organizations are on their journey, or on their Agile transformation, or whatever we want to call this. And I don't want to even go into the debate whether transformation is a good term or not. But at some point, right, the topic of finance, controlling, budgeting, all of this comes up because organizations ultimately realize it's not about having a few teams work differently. It's about implementing a new what I call operating system in our organization. And budgets are a key component of that. Now, at what point on an organization's journey would you approach that topic of budgets? Where would you do that, like on which level. And how would you do that?

Bjarte:

First of all, I will kind of extend this beyond budget. Is this the command... a budget is just a way of exercising command or control right?

Sohrab:

Yes, yes.

You have to address commanc and control

Bjarte:

And many other ways you can do it as well. So it is the command or control thing including budgeting you have to address. And today we are very often called in to help organizations on these transformation journeys because they all realized at one point in time and often late that we will never succeed without also addressing the stuff that we are talking about. And again, as I was touching upon, I mean, we are filling some holes in Agile when it comes to scaling agile into how to run an organization. And it's better to be called in late than not to be called in at all. But the best thing is to address these things upfront.

And one reason for addressing it upfront is that the message, the change message is so powerful because this is a process that basically everybody hates. And if corporate is telling that we are gonna address this, attack it, change it for the better, that is a strong thing that changes for real, just as the opposite of not doing anything is a very strong signal that this change is not for real. So I would recommend to do it upfront, but better late than never.

Sohrab:

Now, and I would assume, and I might be wrong here, that addressing this topic requires at least CFO involvement, right?

Bjarte: At one point, yes. But I mean, we have examples where the finance function has convinced the CFO, which then has convinced the CEO, and we have actual examples where HR has been kind of just as strong in this as finance. And we strongly recommend actually finance and HR to work together on this, for the reasons I just talked about, this being just as much about leadership as management processes.

Sohrab:

Now, when you get into these conversations with leaders in the org, maybe even the CFO, but no matter who, I believe that a lot of the things that you covered today will really challenge their, let's say, comfort zone. How do you deal with that?

Bjarte:

Well, I have to admit that I kind of, I always kind of assess or try to assess the team or the executive, I'm gonna address because if you kind of... some, if you actually are completely turned off by starting off like this, and in that case, I'm starting with that budget separation discussion, which is not scary, pure logic, right, and then you can take the bigger stuff afterwards. But again, the big majority, they simply haven't affected on this. They've kind of as with those problems, they have sensed the irritating issues, but they've never realized that this is a systemic and big problem. So we are helping them with understanding that. And, of course, many also do this, because they've always done it, and everybody else is doing it. But that is changing though.

So another thing that helps us is there are so many companies on this journey now. And in some cases, competitors are on this journey, and that typically tend to make companies interested. So it's much easier today to get executive attention than it was 25 years ago, for many reasons. Agile is one reason, the pandemic was another reason. The pandemic is interesting because we've had many other crises earlier. But those earlier crises typically only challenge that second assumption I talked about, that the future is predictable and plannable. But the pandemic also challenged the first one, that you can't trust people, because all the home-work and home offices have forced people to trust our employees, whether they wanted it or not. And we all know that in most cases, it had worked wonderful. So there are some positive things coming out of that pandemic.

Sohrab:

Absolutely, absolutely. I think we still can't wait till this is over. So I will just ask one of the questions a participant has put in the chat for me, which is the correlation between Beyond Budgeting versus rolling forecasting, as a process. Is this the similar thing, is this different? What similarities are there if they are similar?

Is there a correlation between Beyond Budgeting and rolling forecasting?

Bjarte:

Well, rolling forecasting is how you... it's one way of organizing the forecasting process once you have separated these three processes, right? So there is a target-setting process. There's a forecasting process and resource allocation process. And that forecasting process can either be rolling, meaning that you update your forecast typically every quarter, and typically must look five quarters ahead continuously. At Equinor we did what we call dynamic forecasting, which has no predefined frequency and time horizon. So units simply update their forecast when stuff happens that they think justify forecast updates and it goes into a common database. So at corporate level, we can at any time tap into the latest numbers when we have a need for it at corporate level. So rolling forecast is just one of the practices and one of the principles also addressing forecasting.

Sohrab:

Now, my thought came back, and I wanted to ask you, you have worked in many different industries, at least based on the slide that we saw. Do you see differences in those industries in their willingness to apply these techniques, and make this huge shift from my perspective, based on the products and services those organizations built?

Bjarte:

Not necessarily between businesses, but more between cultures.

Sohrab:

Okay. Go ahead.

It's the organizational culture that makes it more challenging or not

Bjarte:

And of course, there are cultures where this is more challenging than in other cultures, that's not a secret. And I often get that question. And I want my responses is always, well, culture can be an issue a challenge, but it should never be a showstopper. And also, I think we sometimes make these cultural differences sometimes bigger than what they often are. I mean, there are some amazing Beyond Budgeting cases in South America and China, Japan, as some examples. But I mean, if you think about those different industries or businesses, the fascinating thing is how similar the problems are when it comes to budgets. That budget problem list kind of is relevant, independent, or what kind of business you're in. So this is a very generic problem that everybody recognize.

Sohrab:

Yeah, I can imagine. So the problems are similar, their willingness to change and adapt is, again, different based on the different cultures they have, but we have examples everywhere. Now, let me close with one question that is always important to me. It's about culture. And if I remember correctly, you mentioned that there needs to be a coherence between strategy, mission, board, whatever culture of the organization, and then the things that they do. Now, what I have seen in my years working with organizations, and it's not as many as yours yet, but is that culture is something that is based that is created, or that is the result of the things that we do, and the policies that we have, the structures that we have, the metrics that we use to measure success. And when I look at Beyond Budgeting, and the principles you talked about, the activities,you can do, the practices in there, I think many of them can result in a huge culture shift in an organization. So do you have that conversation with CEOs, CFOs, as well, and ask them whether they actually want that culture shift?

Bjarte: Absolutely, I mean, because sometimes we are called in because somebody wanted to fix a budget problem, right? And again, then what you're saying is that this is not... is about much more than budgets, this is about how to run an organization, and you need to be clear about what kind of problems you're trying to fix. And fortunately, more and more have bigger and bigger aspirations. They realize we are working with a huge French company right now. And they realized that they have a culture of internal negotiations and lowballing and gaming and sandbagging all the things that they want to get away from. And we are trying to help them to understand that is a result of the system that they have set up and, you know, process drive culture, so I very much agree with you that you can work and change cultures by doing important things on the process side. Could I say one more thing before we leave?

Sohrab: Yes.

Bjarte:

If you don't mind. What I've been talking about today. I mean, it will happen. I don't care if it's gonna be called Beyond Budgeting or business agility or whatever. I couldn't care less, but it will happen. And in 15, 20 years time when we look back at what was mainstream management in 2021, I think we will smile, even have a laugh, just like we today smile about the days before the internet or the smartphone. And how long is that? And that's organizations we can choose to be vanguards, early movers and get the competitive advantage by doing this now, or we can choose to be dragged into this as one of the last ones. I think that is a very simple choice. Thank you very much.

Sohrab:

Thank you, Bjarte. And I think this is a wonderful final sentence and note to everyone participating here.